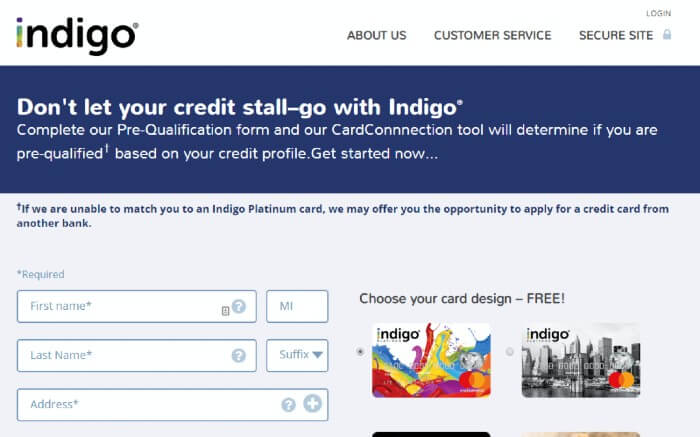

If individuals are thinking of rebuilding their credit score and don’t have an adequate option, the Indigo Platinum Mastercard is a great alternative to get their hands on. However, they must be prequalified to assist in determining the status of the final approval of the IndigoCard Login account.

If IndigoCard is confirmed and approved, the credit activity will be published to all three credit agencies as soon as a cardholder starts utilizing the card and does the primary transaction. This report is mandatory as consistent positive action is a base for establishing an adequate credit score.

The most reliable way to build the credit score with this IndigoCard is to make small, conventional purchases so that they can keep the card active and have a positive payment record. Try to keep the total balance under $ 100 and perform the transactions before the final date.

Consequently, IndigoCard holders should never utilize more than 30% of the available total balance. Most significantly, when users can pay off the entire balance on time and in full every month then it turns out to be the most effective way for the higher credit limit.

The two common but remarkable parts of the credit score are the cost of the loan that the account holder has used and the repayment history. The Indigo Card gives notifications about new contrary claims on the TransUnion credit report, along with the basic data on credit card specifications at www.indigocard.com.

Individuals also have access to a client service application or chat functionality which is officially offered by IndigoCard.com. The official recommended that cardholders must reach out to the customer care delegates in case of any query to overlook future issues.

IndigoCard is officially assigned by Celtic Bank, which is a private bank established in Utah. As a small card issuer to the credit cardholders, Celtic Bank provides every possible assistance and services to the valuable clients.